Your Medical Benefits

Welcome

Welcome to West Central Behavioral Health. We are dedicated to ensuring the health and well-being of our employees. We are pleased to provide you with two health plans through Harvard Pilgrim Health Care. These plans include comprehensive medical care, prescription coverage, and resources to support you in maintaining a healthy lifestyle.

Eligibility

Newly hired, regular part-time employees working 20 hours or more, and regular full-time employees working 30 hours or more will be eligible to enroll in health insurance benefits during the new employee orientation period. Eligibility begins on the first of the month following the date of hire.

Benefit Information

How do I enroll?

To enroll in benefits, all employees must submit their benefit elections through UKG Ready.

If you miss the new hire or open enrollment window, you will have to wait until the next open enrollment period to enroll in benefits unless you experience a qualifying life event.

Waiving or Declining Health Insurance

If you are eligible for health insurance but have alternative coverage or choose not to have insurance, you must sign a waiver form during the enrollment period. If you decide not to enroll, you won’t be able to join the plan until the next Open Enrollment period, unless there is a “qualifying event.” A Qualifying Life Event is a life-changing situation that allows you to make changes to your benefit elections outside of the normal Open Enrollment period. Examples of Qualifying Life Events include the birth of a child, marriage, divorce, and loss of other coverage.

All employees should be aware of possible federal tax penalties for declining the health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, visit: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave West Central Behavioral Health?

Under certain circumstances, you and your dependents may continue participating in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act. COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums plus 2%. Employees have 60 days to make a COBRA election.

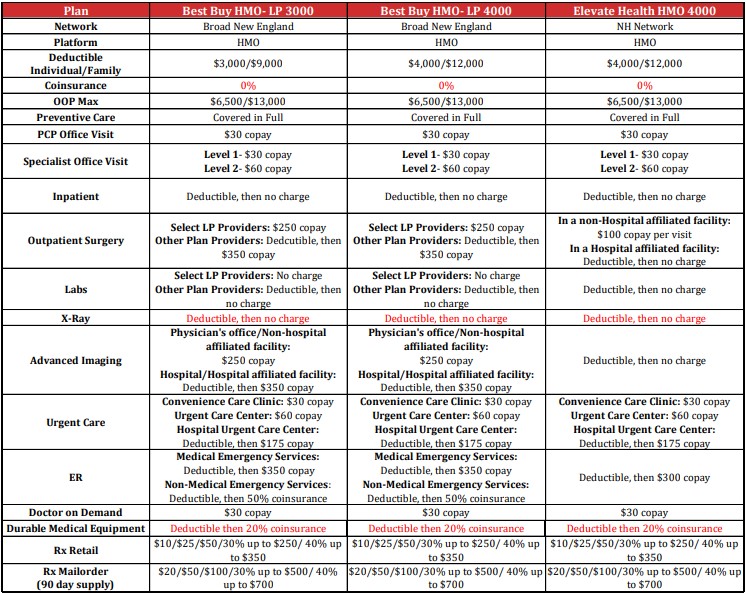

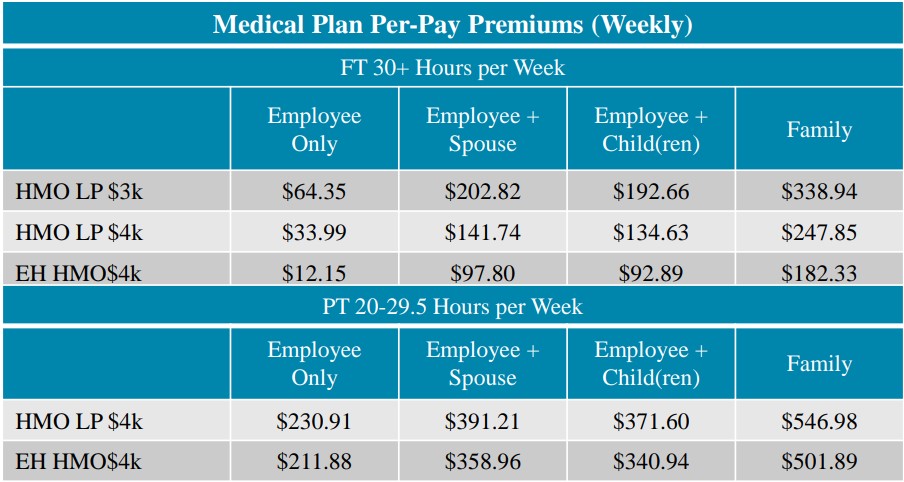

*New this year in 2025*, WCBH is offering a 3rd medical plan option through HPHC. This is the Elevate Health HMO 4000, which offers the same benefits as the Best Buy HMO – LP 4000 but operates on a more limited network.

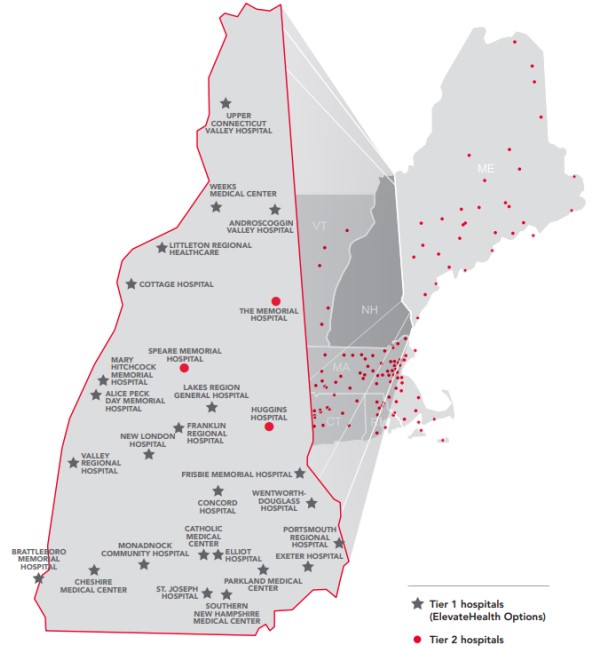

The Best Buy HMO- LP 3000 and Best Buy HMO- LP 4000 operate on Harvard Pilgrim’s Broad New England Network, with access to out-of-state providers including many major Boston Hospitals, Springfield Hospital and Mt Ascutney Hospital. Both Tier 1 and Tier 2 hospitals participate in the Broad New England network.

The Elevate Health HMO 4000 operates on a limited network of New Hampshire providers and hospitals, with the only out-of-state addition being Brattleboro Memorial Hospital located in Vermont. Only Tier 1 hospitals participate in the ElevateHealth network.

Plan Documents

Schedule of Benefits (SOB)

Summary of Benefits & Coverage (SBC)

Summary Plan Description (SPD)/Benefit Handbook

Pharmacy/RX Information

Helpful Resources

Your Health Advocate

Welcome to West Central Behavioral Health. We are dedicated to ensuring the health and well-being of our employees. We are pleased to provide you with with a Health Advocate Program to employees enrolled in medical coverage.

At Health Advocate, we’re here to help you and your family with any health or well-being issues. Our services are provided to you by WCBH. Just call, tap, or click to reach us and receive confidential, personalized support from our caring team. Our goal is to make your life happier, healthier, and easier. We’re here for your no matter what, to help with anything you need, anytime you need it, in the language and communication channel you are most comfortable using.

Connect with us to:

- Get answers to your insurance questions; resolve claims and billing issues

- Understand your coverage for medical, dental and vision services; know your deductibles, copays and out-of-pocket costs

- Get assistance finding in-network doctors and specifliast for your specific needs, making appointments, and transferring medical records.

- Explore and find latest treatment options; get second opinions

- Feel confident that your medical care and treatment is on track

How do I access Health Advocate?

Our website and mobile app provide another layer of support you can access anytime, anywhere.

- Talk with an advocate in real time through chat

- Learn about your Health Advocate services and the many ways we can help you

- View important news alerts and helpful tips to stay on top of your health

- Download your Rx shopper discount card to find the lowest costs on your prescriptions

- Access trusted, expert vetted information on virtually every health topic.

- Open a case, download forms, and view your case status.

We’re not an insurance company. Health Advocate is not a direct medical care provider and is not affiliated with any insurance company or third-party provider. Your privacy is protected Our staff carefully follows protocols and complies with all government privacy standards. Your medical and personal information is kept strictly confidential.

![]()

Available 24/7

Customer Service: (866) 695-8622

E-mail: answers@HealthAdvocate.com

Website: http://HealthAdvocate.com/WestCentralServices

- Registration Code: ULPRF5S

Helpful Resources

Your Dental Benefits

Eligiblity

Newly hired, regular part-time employees working 20 hours or more and regular full-time employees working 30 hours or more will be eligible to enroll in dental insurance benefits during the new employee orientation period. Eligibility begins on the first of the month following the date of hire.

How do I enroll?

To enroll in benefits, all employees must submit their benefit elections through UKG Ready.

If you miss the new hire or open enrollment window, you must wait until the next open enrollment period to enroll in benefits unless you experience a qualifying life event.

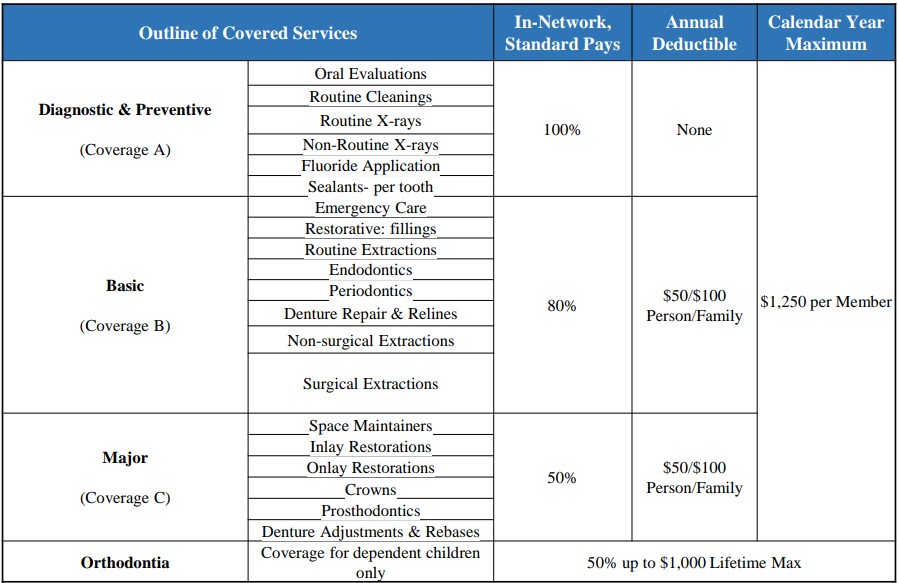

Plan Overview

WCBH offers a dental plan through The Standard, operating on the Classic Network.

The chart below provides a high-level overview of the dental plan design and features offered to eligible employees by WCBH. Please reference the Dental Summary of Benefits and the Dental Contribution Schedule for more information about your plan and cost per pay period.

Carrier Contact Information

The Standard

Customer Service: (800) 547-9515

Website: http://www.thestandard.com/services

Plan Documents

Your Vision Benefits

Eligiblity

Newly hired, employees working 20 hours or more will be eligible to enroll in vision insurance benefits during the new employee orientation period. Eligibility begins on the first of the month following the date of hire.

How do I enroll?

To enroll in benefits, all employees must submit their benefit elections through UKG Ready.

If you miss the new hire or open enrollment window, you must wait until the next open enrollment period to enroll in benefits unless you experience a qualifying life event.

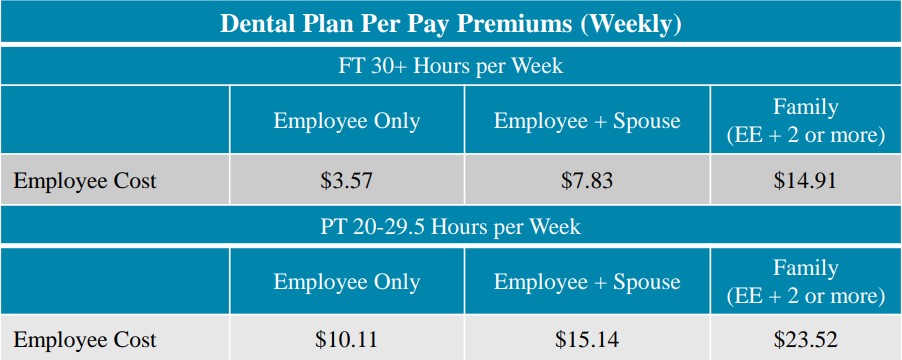

Plan Overview

WCBH pays for a vision plan through VSP on your behalf. This plan lets you see care from any licensed vision provider through the VSP Choice Network. Please reference the Vision Benefits Summary under Plan Documents for more detailed coverage information.

Carrier Contact Information

VSP: Vision Insurance

Customer Service: (800) 877-7195

Website: www.vsp.com

Vision Contribution Schedule

WCBH fully covers your vision benefits with no paycheck deductions.

Plan Documents

Helpful Resources

Your Flexible Spending & Dependent Care Account Benefit

Eligibility

All employees, regardless of their status, are eligible to participate in the healthcare FSA and dependent care FSA. Enrollment in WCBH’s medical plan is not required to participate.

Flexible Spending Account (FSA)

WCBH offers both healthcare Flexible Spending Accounts (FSA) and dependent care (DCA) flexible spending accounts. Employees may contribute pre-tax dollars into these accounts to help offset eligible medical expenses or dependent care expenses.

How does a healthcare Flexible Spending Account Work?

A healthcare FSA is a flexible spending account that allows you to set aside pre-tax dollars for eligible medical, dental, and vision expenses for you and your dependents, even if they are not covered under your primary health plan.

West Central Behavioral Health has set a maximum contribution limit of $1,500. You can choose any annual election amount up to $1,500. At the beginning of the plan year, your account is pre-funded, and your full contribution is available immediately for use. Then, the chosen election amount is deducted from your paychecks in equal installments throughout the year.

Why should I enroll in a healthcare FSA?

Almost everyone has some level of predictable and non-reimbursable medical needs.

If you expect to incur medical expenses that another plan won’t reimburse, you’ll want to take advantage of this plan’s savings. Money contributed to a healthcare FSA is free from federal and state taxes and remains tax-free when spent on eligible expenses.

For a full list of qualified expenses allowed by the IRS, please click here to access the IRS 502 Publication

Dependent Care

How does a dependent care FSA work?

A dependent care FSA is a flexible spending account that allows you to set aside pre-tax dollars for dependent care expenses, such as daycare, that allow you to work or look for work.

You choose an annual election amount of up to $5,000 per family. The money is placed into your account via payroll deduction in equal installments and then used to pay for eligible dependent care expenses incurred during the plan year.

Please note that the DCA is 100% employee-funded and is only available to use when monetary contributions are made.

Why should I enroll in a dependent care FSA?

Child and dependent care is a large expense for many families. Millions of people rely on childcare to be able to work, while others are responsible for older parents or disabled family members.

If you need to pay for the care of dependents to work, you’ll want to take advantage of the savings this plan offers. Money contributed to a dependent care account is free from federal and state taxes when spent on eligible expenses.

How to Enroll?

Whether enrolling for the first time or continuing to participate in the new plan year, you will elect via employee self-service on UKG Ready. You must designate the total amount you have decided to set aside and acknowledge the weekly payroll deduction amount.

How do I access my account?

Once you have enrolled in your FSA/DCA account, you can access your account by visiting www.flores247.com and logging in under the “Participant Login” option on the left using your Participant ID or username and password.

Carrier Contact Information

Member Services: (800) 532-3327

Website: https://www.flores247.com

2025 FSA/DCA Annual Contribution Limits

| Benefit | 2025 Limit |

|---|---|

| HealthCare FSA | $1,500 |

| Dependent Care (DCA) | $5,000 per household |

| Dependent Care (DCA) | $2,500 if married, filing seperately |

Plan Documents

Sample FSA Qualifying Expenses List

| What Qualifies? | What doesn’t qualify? |

|---|---|

| Copays, deductibles, coinsurance | Expenses incurred in a prior plan year |

| Doctor office visits, exams, lab work, x-rays | Cosmetic procedures/surgery |

| Hospital Charges | Dental products for general health |

| Rx Drugs | Hygiene products |

| Dental exams, x-rays, fillings, crowns | Insurance Premiums |

| Vision exams, frames, contact lenses, and more | Late payment fees charged by healthcare providers |

| Physical Therapy | |

| Chiropractic Care | |

| Over-the-counter medications | |

| And much more…. |

Sample DCA Qualifying Expense List

| What Qualifies? | What doesn’t qualify? |

|---|---|

| Before & After school care for children 12 and under | Expenses occurred in prior plan year |

| Custodial care for dependent adults | Expenses for non-disabled children 13 and older |

| Licensed daycare centers | Educational expenses including kindegarten or private school tuition fees |

| Nanny/Au Pair | Food, clothing, sports lessons, field trips and entertainment |

| Nursery Schools or preschools | Overnight camp expenses |

| Late pick-up fees | Late payment fees for child care |

| Summer or holiday camps |

FSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

Your Employer Paid Group Life and Accidental Death and Dismemberment (AD&D) Insurance

Overview of Group Life & AD&D Coverage

Life insurance provides the people you love with financial support when you can’t be there – and when they need it most.

West Central Behavioral Health provides a benefit of 1x your annual earnings up to a max of $150,000 – with no medical questions asked. Benefits are reduced by 50% when you attain the age of 70.

Your Accidental Death & Dismemberment (AD&D) coverage equals your Group Life benefit.

What happens if I leave West Central Behavioral Health?

Your Group Life Insurance and AD&D coverage ends at termination of employment or retirement. You have the option to convert your group policy to an individual policy within 31 days after termination. Please contact SunLife Financial for more information on converting your policy.

Eligibility

All regular full-time employees working 30 hours or more will be eligible for Group Life and AD&D. Eligibility begins on the first of the month following the hire date.

How do I enroll?

To enroll in benefits, all employees must submit their benefit elections through UKG Ready.

Carrier Contact Information

SunLife: Basic Life and AD&D

Customer Service: (800) 786-5433

Website: www.sunlife.com/us

Contributions

Group Basic Life and AD&D is 100% paid for by West Central Behavioral Health.

Plan Documents

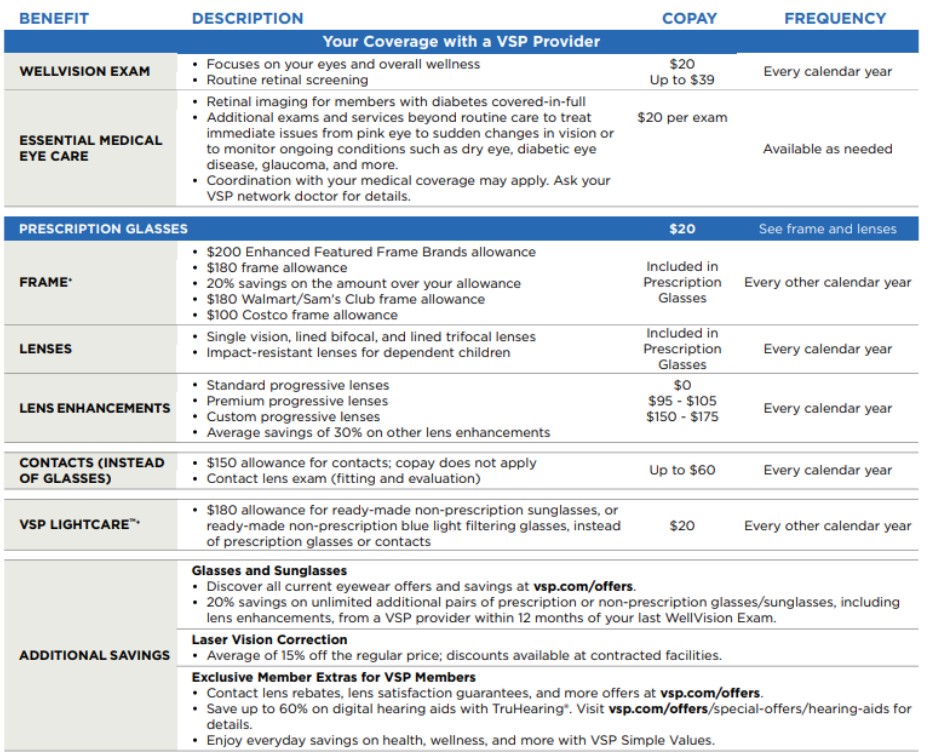

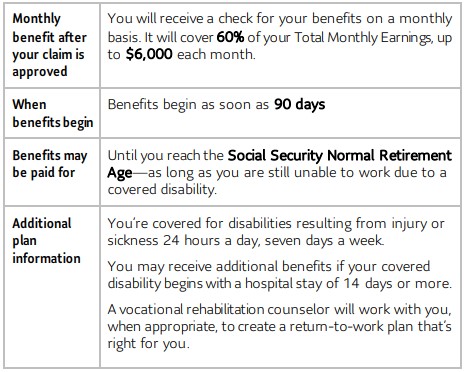

Your Voluntary Short & Long Term Disability Benefit

Overview of Voluntary Short & Long-Term Disability Insurance

Short Term Disability

If you injure your back and your doctor advises you to take four weeks off work, or if you’ve just had a baby and need time off, short-term disability insurance can help replace part of your income during this non-work related, covered disability.

Long Term Disability

An accident or illness can put your life on hold. It may mean you can’t work for an extended period of time. How do you pay your bills? Long-term disability replaces part of your income due to a non-work-related covered disability.

Eligibility

All regular full-time employees working 30 hours or more will be eligible to participate in Voluntary Short—and Long-Term Disability Insurance. Eligibility begins on the first of the month following the hire date.

Employees will enroll via the UKG Ready employee self-service portal.

Plan Documents

Carrier Contact Information

SunLife: Short & Long Term Disability

Customer Service: (800) 786-5433

Website: www.sunlife.com/us

Contributions

| Voluntary Short Term Disability Rates – Rates per $10 of benefit | |||

|---|---|---|---|

| Age | Rates | Age | Rates |

| 0-19 | 1.07 | 60-64 | 1.83 |

| 20-24 | 1.07 | 65-69 | 1.83 |

| 25-29 | 1.07 | 70-74 | 1.83 |

| 30-34 | 1.07 | 75-79 | 1.83 |

| 35-39 | 1.07 | 80-84 | 1.83 |

| 40-44 | 0.97 | 85-89 | 1.83 |

| 45-49 | 0.97 | 90-94 | 1.83 |

| 50-54 | 1.29 | 95-99 | 1.83 |

| 55-59 | 1.29 | ||

| Voluntary Long Term Disability Rates – Rates per $10 of benefit | |||

|---|---|---|---|

| Age | Rates | Age | Rates |

| 0-19 | 0.35 | 60-64 | 3.12 |

| 20-24 | 0.35 | 65-69 | 3.49 |

| 25-29 | 0.51 | 70-74 | 3.49 |

| 30-34 | 0.82 | 75-79 | 3.49 |

| 35-39 | 1.20 | 80-84 | 3.49 |

| 40-44 | 1.36 | 85-89 | 3.49 |

| 45-49 | 1.88 | 90-94 | 3.49 |

| 50-54 | 2.50 | 95-99 | 3.49 |

| 55-59 | 3.28 | ||

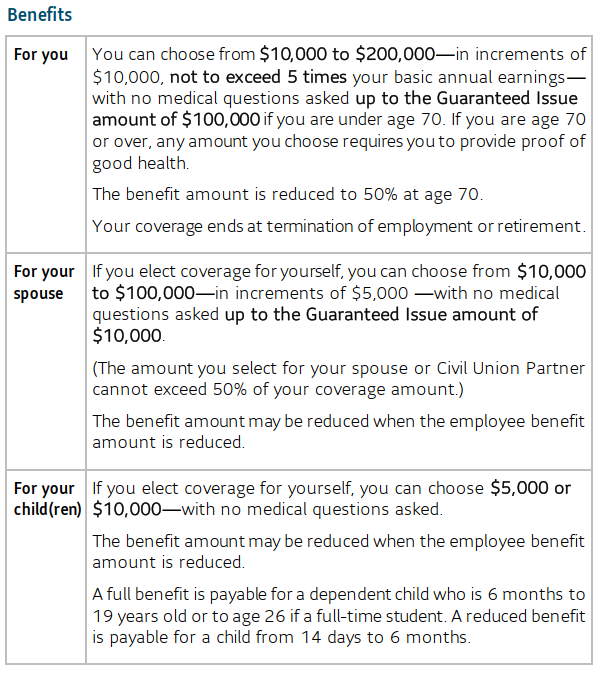

Your Voluntary Term Life Insurance Benefit

Overview of Voluntary Life Insurance

The people you love and support could face challenges if you are no longer around. Life Insurance provides your loved ones with money they can use for household expenses, tuition, mortgage payments, and more.

Choose the benefit that best fits your needs and budget. Please refer to the Benefit Chart below and the Contribution Schedule for age-based rates.

Eligibility

All regular full-time employees working 30 hours or more will be eligible for Voluntary Term Life Insurance. Eligibility begins on the first of the month following the hire date.

How do I enroll?

To enroll in benefits, all employees must submit their benefit elections through UKG Ready.

If you miss the new hire or open enrollment window, you must wait until the next open enrollment period to enroll in benefits unless you experience a qualifying life event.

Plan Documents

Carrier Contact Information

SunLife: Voluntary Term Life Insurance

Customer Service: (800) 786-5433

Website: www.sunlife.com/us

Contribution Schedule

Voluntary Term Life is paid for by the employee based on the rate tables below.

| Voluntary Life: Employee – Rates per $1,000 of Benefit | |||

|---|---|---|---|

| Age | Rates | Age | Rates |

| 0-19 | 0.05 | 60-64 | 1.43 |

| 20-24 | 0.05 | 65-69 | 2.19 |

| 25-29 | 0.05 | 70-74 | 3.21 |

| 30-34 | 0.08 | 75-79 | 5.87 |

| 35-39 | 0.11 | 80-84 | 8.97 |

| 40-44 | 0.17 | 85-89 | 16.41 |

| 45-49 | 0.31 | 90-94 | 22.14 |

| 50-54 | 0.53 | 95-99 | 48.30 |

| 55-59 | 0.87 | ||

| Voluntary Life: Spouse – Rates per $1,000 of Benefit | |||

|---|---|---|---|

| Age | Rates | Age | Rates |

| 0-19 | 0.05 | 60-64 | 1.43 |

| 20-24 | 0.05 | 65-69 | 2.19 |

| 25-29 | 0.05 | 70-74 | 3.21 |

| 30-34 | 0.08 | 75-79 | 5.87 |

| 35-39 | 0.11 | 80-84 | 8.97 |

| 40-44 | 0.17 | 85-89 | 16.41 |

| 45-49 | 0.31 | 90-94 | 22.14 |

| 50-54 | 0.53 | 95-99 | 48.30 |

| 55-59 | 0.87 | ||

| Voluntary Life – Child – Rates per Benefit Level | |

|---|---|

| Benefit | Rate |

| $5,000 | 0.85 |

| $10,000 | 1.70 |

Your Voluntary Accident & Critical Illness Benefit

Eligibility

All regular part-time and full-time employees working 20 hours or more will be eligible to participate in Voluntary Accident and Critical Illness Insurance. Eligibility begins on the first of the month following the hire date.

How do I enroll?

All employees will enroll in benefits via the UKG Ready employee self-service portal.

If you miss the new hire or open enrollment window, you must wait until the next open enrollment period to enroll in benefits unless you experience a qualifying life event.

How can SunLife help me?

- Accident Coverage – Supplemental Accident Insurance that helps with what your health insurance plan might not cover.

- Critical Illness Coverage – Critical Illness insurance helps with the treatment costs of life-changing illnesses and health events, like a stroke or heart attack.

2025 Employee Accident Contribution Rates

| Coverage Level | Monthly Cost | |

|---|---|---|

| Low Plan | High Plan | |

| Employee | $5.74 | $9.35 |

| Employee + Spouse | $10.69 | $17.43 |

| Employee + Child(ren) | $11.68 | $19.50 |

| Employee + Family | $16.63 | $27.58 |

2025 Employee Critical Illness Contribution Rates

| Coverage Amounts | <25 | 25-29 | 30-34 | 35-39 | 40-44 | 45-49 | 50-54 | 55-59 | 60-64 | 65-69 | 70-74 | 75+ |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $5,000 | 2.69 | 2.99 | 3.74 | 4.89 | 7.09 | 10.49 | 15.04 | 21.09 | 29.84 | 41.69 | 57.74 | 79.99 |

| $10,000 | 4.34 | 4.94 | 6.44 | 8.74 | 13.14 | 19.94 | 29.04 | 41.14 | 58.64 | 82.34 | 114.44 | 158.94 |

| $15,000 | 5.99 | 6.89 | 9.14 | 12.59 | 19.19 | 29.39 | 43.04 | 61.19 | 87.44 | 122.99 | 171.14 | 237.89 |

| $20,000 | 7.64 | 8.84 | 11.84 | 16.44 | 25.24 | 38.84 | 57.04 | 81.24 | 116.24 | 163.64 | 227.84 | 316.84 |

2025 Spouse Critical Illness Contribution Rates

| Coverage Amounts | <25 | 25-29 | 30-34 | 35-39 | 40-44 | 45-49 | 50-54 | 55-59 | 60-64 | 65-69 | 70-74 | 75+ |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $5,000 | 1.87 | 2.02 | 2.39 | 2.97 | 4.07 | 5.77 | 8.04 | 11.07 | 15.44 | 21.37 | 29.39 | 40.52 |

| $10,000 | 2.69 | 2.99 | 3.74 | 4.89 | 7.09 | 10.49 | 15.04 | 21.09 | 29.84 | 41.69 | 57.74 | 79.99 |

| $15,000 | 3.52 | 3.97 | 5.09 | 6.82 | 10.12 | 15.22 | 22.04 | 31.12 | 44.24 | 62.02 | 86.09 | 119.47 |

| $20,000 | 4.34 | 4.94 | 6.44 | 8.74 | 13.14 | 19.94 | 29.04 | 41.14 | 58.64 | 82.34 | 114.44 | 158.94 |

2025 Child(ren) Critical Illness Contribution Rates

| Coverage Amounts | Cost – pay period (monthly) premium |

|---|---|

| $2,500 | 1.73 |

| $5,000 | 3.45 |

Carrier Contact Information

SunLife Financial: Accident & Critical Illness

Customer Service: (800) 786-5433

Website: http://www.sunlife.com/us

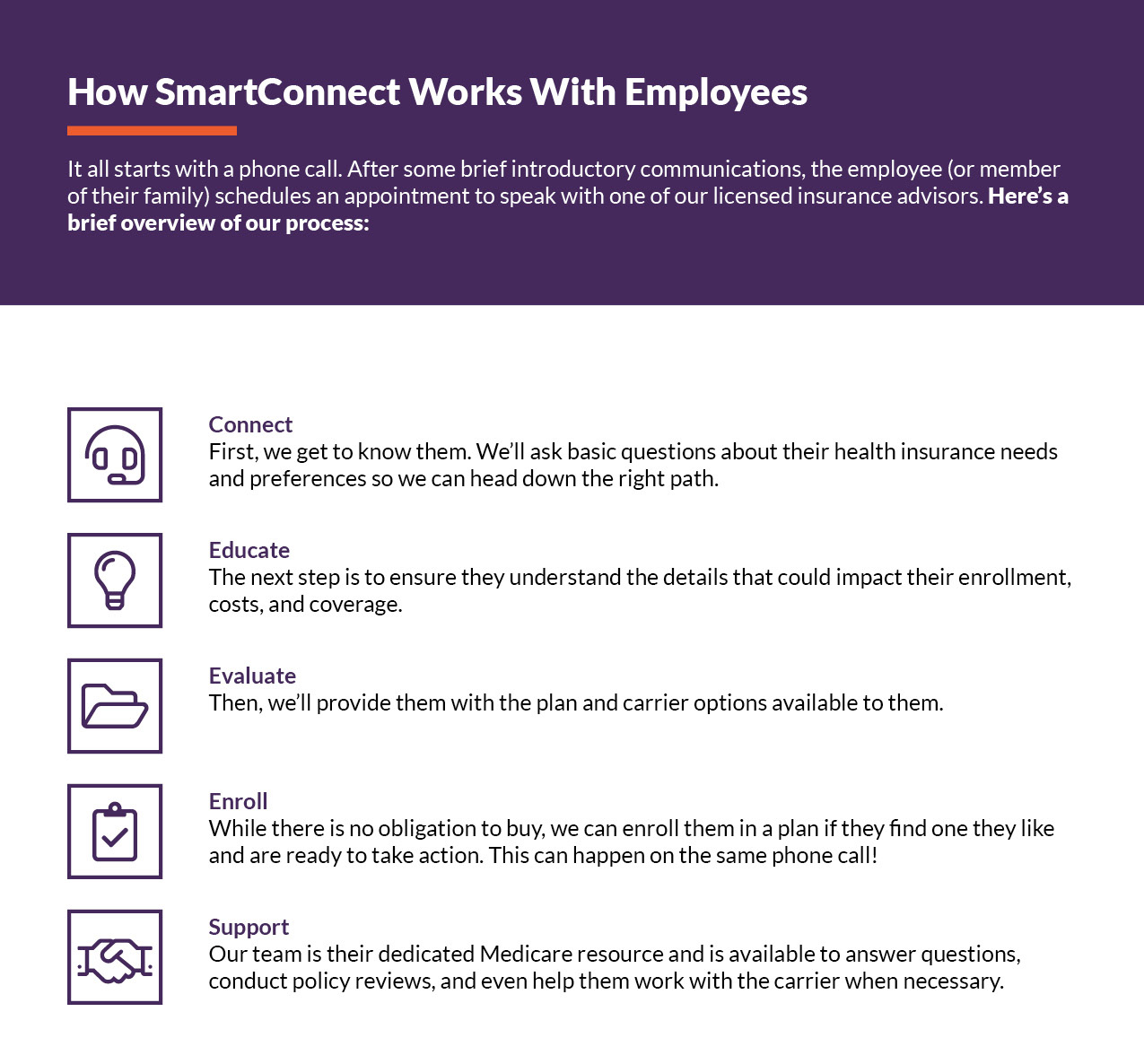

SmartConnect – Medicare Resource

West Central Behavioral Health has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

Eligibility:

This benefit is available to all employees of West Central Behavioral Services.

Member Services

Phone: (888) 572-2607

Website: https://gps.smartconnectplan.com/wcbh

Hours: Monday – Friday 7:30 a.m. – 5:00 p.m. CT

Additional Information

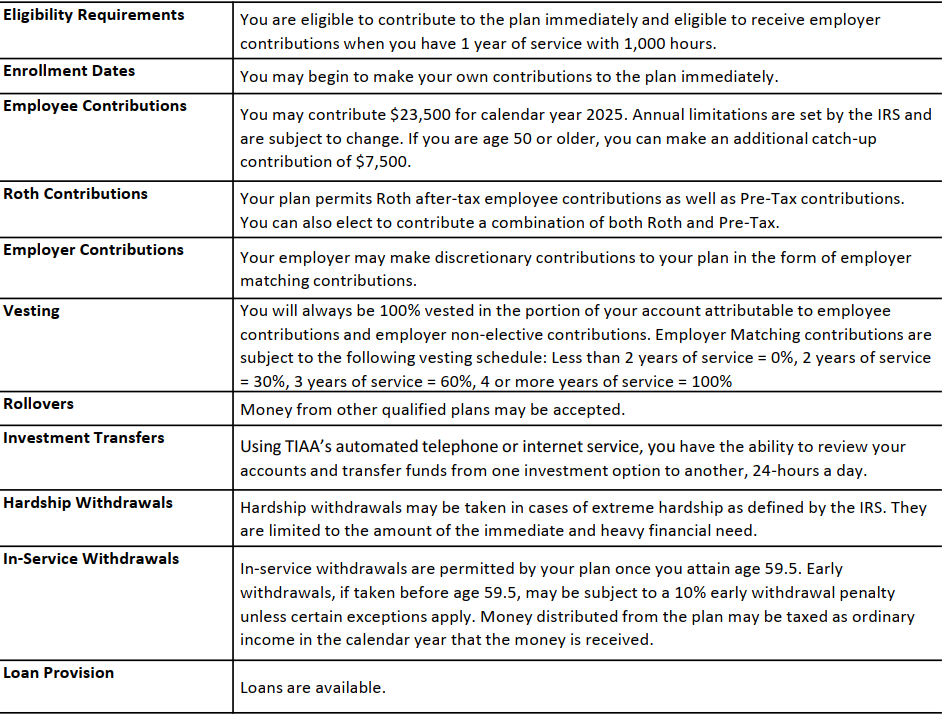

Your Retirement Benefits

Retirement Savings Plan

West Central Services, Inc. offers a 403(b) plan to employees through TIAA. TIAA offers a wide selection of investment options and excellent online technology to help you better plan for retirement. Basic plan details are listed below and outlined in more detail in the Summary Plan Description. If you have questions about the plan, you can send an email to HelpRetire@therichardsgrp.com to receive assistance from TRG Retirement Plan Consultants. You can also call TIAA directly at (800) 842-2252 or access your account online at https://www.tiaa.org/public/tcm/wcsnh.

Additional Information

TRG Retirement Plan Consultants:

helpretire@therichardsgrp.com

(802) 254-6016

Financial Wellness

Financial Wellness Resource

Organizing your finances is key to improving your financial well-being. Get started today with Savology, a web-based financial wellness platform that helps you plan and improve your financial future. Start by taking a financial assessment, and receive customized materials made just for you, with resources such as financial literacy courses and planning modules designed to help improve financial outcomes.

Savology is available as a financial wellness and financial literacy resource to all employees.

To Enroll:

To enroll, go to: Savology Registration

(802) 254-6016

Additional Information about Savology

Your Employee Assistance Program

Eligibility

All employees and their family members are eligible upon hire.

Program Details

Each of us encounters personal problems from time to time, and that is why West Central Behavioral Service has partnered with Totalcare EAP to provide you with the best possible solutions for everyday issues that you or one of your family members may face. Your EAP is here to help.

The following free benefits are available for Employees and Family Members.

Talkspace Go!

Talkspace Go is a popular therapy app designed to enhance mental health and well-being in just 5 minutes a day. It provides confidential support for issues such as relationships, parenting, depression, anxiety, stress, burnout, trust, career, and more through self-guided, interactive courses. The app also offers optional weekly counselor-led classes, journaling, meditation exercises, assessments, and much more. It is available for download to your Employees and their eligible family Members aged 13 and up. Please reference the ” EAP Talkspace Go” flyer under helpful resources for more information.

COUNSELING BENEFITS

Help from experienced Masters or Ph.D. level counselors for personal issues such as relationships/family, depression/anxiety, grief, and more.

PEAK PERFORMANCE COACHING

Personal and professional coaching is available from senior-level ESI coaches. Get one-to-one telephonic coaching and support, as well as online self-help resources and training. Topics include but are not limited to certified financial coaching, work-life balance, student debt, workplace conflict, and more.

WORK/LIFE BENEFITS

Help for personal, family, financial, and legal issues is available for your everyday work/life problems, such as debt counseling and restructuring, caregiver help and resources, childcare and elder care assistance, financial and legal problems unrelated to employment or medical concerns, and more.

SELF-HELP RESOURCES

Self-help resources give you access to a collection of thousands of tools, videos, financial calculators and informative articles covering virtually every issue you might face, including adoption, relationships, legal, financial, cancer and more.

LIFESTYLE SAVINGS BENEFITS

Includes thousands of discounts, rewards and perks in a variety of categories, such as Health & Wellness, Auto, Restaurants and much more!

WELLNESS BENEFITS

Videos and resources to improve you and your family’s overall health, including fitness, diet and tobacco cessation.

TRAINING & PERSONAL DEVELOPMENT

Access to our extensive library of online personal and professional development training in a variety of easy-to-use formats. Topics include but are not limited to debt, budgeting, communication, stress management, and more!

EAP Contact Information

![]()

The employee assistance program is 100% confidential and available to you and your family 24/7/365 days a year.

Phone: (800) 252-4555

Website: www.theEAP.com

Helpful Resources

Legal Insurance

Legal and financial problems can cause a significant level of stress for employees and contribute to lost work hours, lack of concentration and missed deadlines. LegalGUARD members have access to a national network of attorneys with exceptional experience who are matched to meet specific legal needs. Members also get paid-in-full coverage on most legal matters, as well as personal guidance and coaching. This voluntary plan allows you a wide range of services:

- Home and residential (ex. buying, selling, refinance, foreclosure and landlord/tenant)

- Financial (ex. debts, credit, collections and contracts)

- Auto and traffic (ex. moving violations, tickets and license suspension)

- Family (ex. adoption, child support and child custody)

- Estate planning and wills (example: will, living will and power of attorney)

Legal Insurance Contact Information

Helpful Resources

My Tuition Assistance Benefits

Our tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

Phone: (844) GRADFIN

Website: http://www.gradfin.com/platform/trg

The Wellness Outlet

We offer our employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/